what is income tax malaysia

Chargeable Income RM Annual Calculations RM Rate Tax RM A. Not that not all tax rates and thresholds in Malaysia change annually alterations to tax policy to support strategic economic growth in Malaysia mean that the.

Malaysia Personal Income Tax Guide 2020 Ya 2019

First of all you need an Internet banking account with the FPX participating bank.

. However certain types of income specified in Schedule 6 of the ITA such as foreign source income as per paragraph 28 of Schedule 6 are exempt from income tax. The deadline for filing income tax in Malaysia also varies according to what type of form you are filing. On the First 5000.

In order to avail the online tax payment facility taxpayers must have a net-banking account with an authorised bank. The Personal Income Tax Rate in Denmark stands at 56 percent. Here are the many ways you can pay for your personal income tax in Malaysia.

One must file an income tax return to justify hisher income. 1 Pay income tax via FPX Services. According to LHDN Income Tax Rates page the chargeable income tax in Malaysia for Year Assessment 2021 follows the following table.

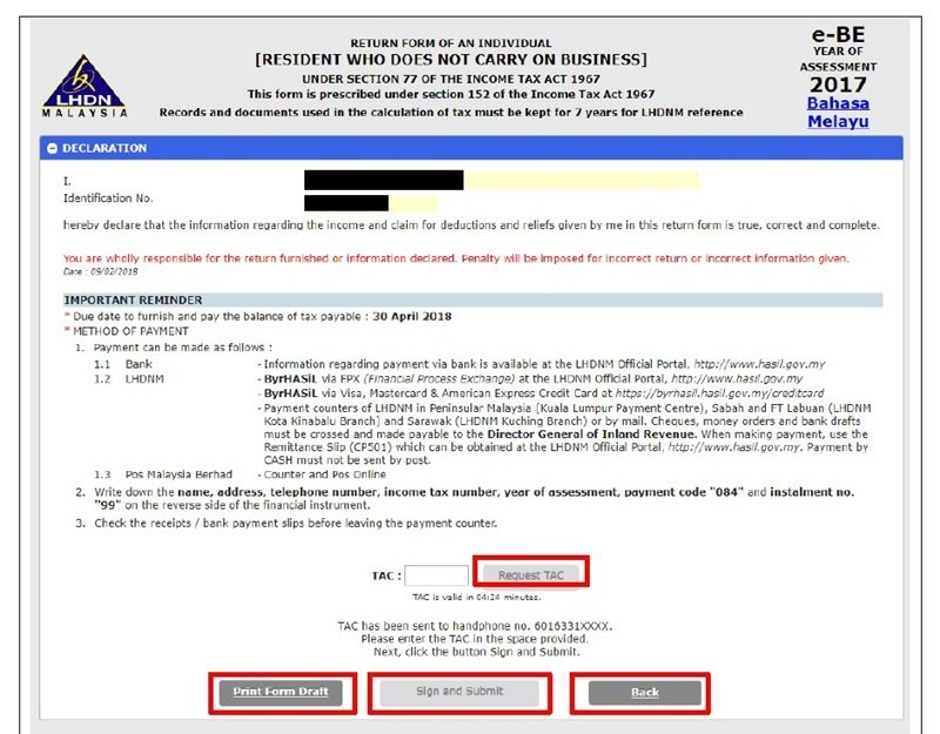

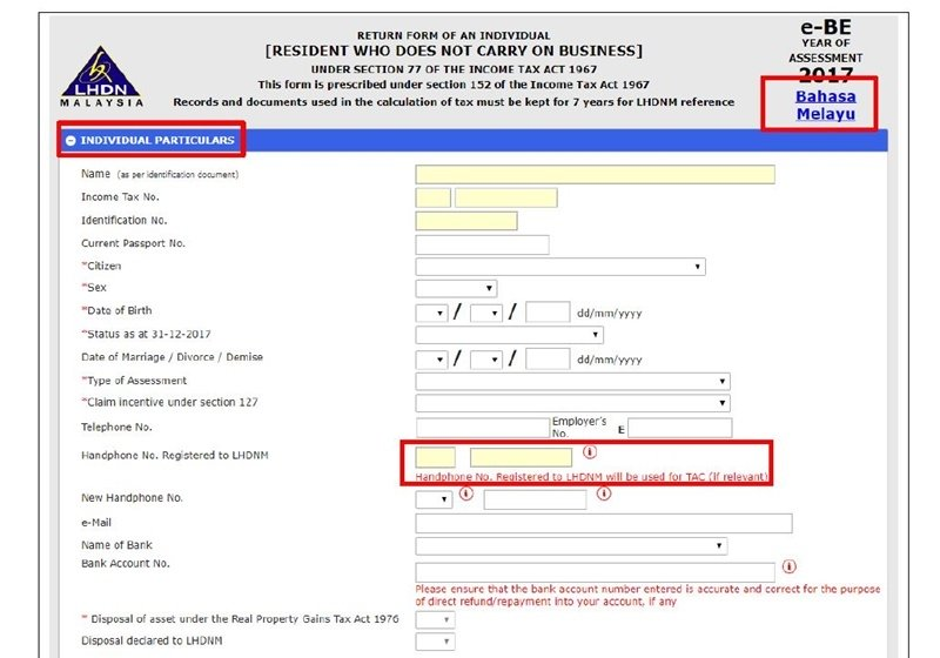

Taxpayers can pay direct taxes online by using the e-Payment facility. The Permanent Account Number PAN or Tax Deduction and Collection Number TAN will have to be provided for validation as well. For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021 for manual filing and 15 May 2021 via e-Filing.

Properties with rental payments exceeding PHP12800 US272 per month received by landlords whose gross annual rental income exceed PHP1919500 US40840 are subject to 12 VAT. Income tax is a tax imposed by the government on the income earned by individuals and businesses. Income Tax in Malaysia in 2022.

As a general rule anyone earning a salary in Malaysia is required to pay income tax unless they fall into one of the exceptions. The FPX Financial Process Exchange gateway allows you to pay your income tax online in Malaysia. On the First 5000 Next 15000.

Jordan Last reviewed 30 June 2022 30. Income Tax Payment Details. In this regard to avail tax advantages to its fullest it is crucial to understand the existing income tax slab for the fiscal year.

All rental income must be reported on your tax return and in general the associated expenses can be deducted from your rental income. Foreign businesses should use the services of established professional services firms to ensure their HR administration is in line with the decree. Income derived from sources outside Malaysia and remitted by a resident company is exempted from tax except in the case of the banking and insurance.

Malaysia adopts a territorial system of income taxation. Japan Last reviewed 08 August 2022 45 plus 21 surtax. As a cash basis taxpayer you generally deduct your rental expenses in the.

See Ivory Coasts individual tax summary for salary tax national contribution and general income tax rates. Income tax Malaysia starting from Year of Assessment 2004 tax filed in 2005 income derived from outside Malaysia and received in Malaysia by a resident individual is exempted from tax. This page provides - Denmark Personal Income Tax Rate - actual values historical data forecast chart statistics economic calendar.

Jersey Channel Islands Last reviewed 22 July 2022 20. Special incentive schemes Reinvestment allowance. On the First 20000.

Malaysia Personal Income Tax Rate. Meanwhile for the B form resident individuals who carry. The participating banks are as follows.

For the most part foreigners working in Malaysia are divided into two categories. The VAT burden is generally shouldered by the tenants. Our suites of tax calculators are built around specific country tax laws and updated annually to provide a dependable tax calculator for your comparison of salaries when looking at new jobs reviewing annual pay.

5 A 12 Value Added Tax VAT is imposed on residential property leases that satisfy certain conditions. In Malaysia income tax is charged based on income accruing in derived from or received in the country as stated under Section 3 of the Income Tax Act 1967 ITA. For example if you take up a job while overseas and you only receive the payment for the job when you are back in Malaysia.

This booklet also incorporates in coloured italics the 2023 Malaysian Budget proposals based on the Budget 2023 announcement on 7 October 2022These proposals will not become law until their enactment and may be amended in the course of their. Average Lending Rate Bank Negara Malaysia Schedule Section 140B. Thus his chargeable income after taking the tax deduction for his donation into account is RM60000 RM6000 RM54000 thus lowering the amount of tax he has to pay.

This publication is a quick reference guide outlining Malaysian tax information which is based on taxation laws and current practices. A resident company in operation for not less than 36 months that incurs capital expenditure to expand modernise automate or diversify its existing manufacturing business or approved agricultural project is. Malaysia adopts a territorial approach to income tax.

Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in Malaysia. Tax relief period in terms of years. Personal Income Tax Rate in Denmark averaged 5981 percent from 1995 until 2022 reaching an all time high of 6590 percent in 1997 and a record low of 5540 percent in 2010.

No other taxes are imposed on income from petroleum operations. If you are a cash basis taxpayer you report rental income on your return for the year you receive it regardless of when it was earned. So questions like how to calculate my income tax will not be stopping you from getting your income tax returns.

Kazakhstan Last reviewed 01. An effective petroleum income tax rate of 25 applies on income from petroleum operations in marginal fields. Income Tax SlabBrackets Applicable for FY 2019-20.

In addition to the mentioned new income tax thresholds Cambodias government has agreed to increase the minimum wage for the countrys textile garment and footwear TGF industries to US200 per. Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. Taxes including personal income tax expenses and limitations are reviewed by the Government in Malaysia periodically and typically updated each year.

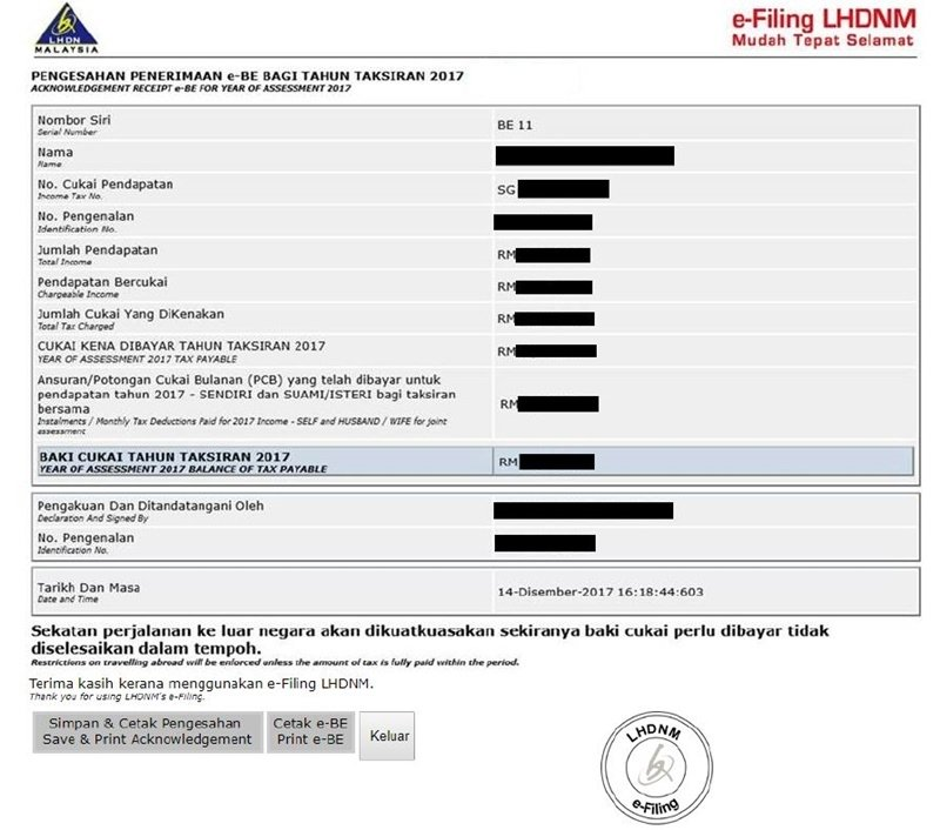

Unlike the traditional income tax filing where you have to print out the income tax form and fill it in manually the e-Filing income tax form calculates your income tax for you automatically. There are no other local state or provincial. Jamaica Last reviewed 08 September 2022 25.

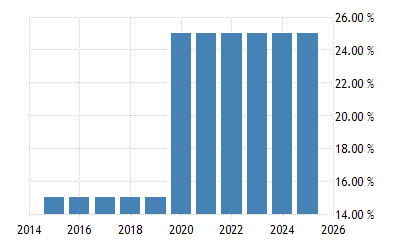

A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum of 30 on chargeable income exceeding RM2000000 with effect from YA 2020. A company whether resident or not is assessable on income accrued in or derived from Malaysia. Malaysia Corporate Income Tax Rate.

Since this donation is limited to 10 of his aggregate income he can claim RM6000 10 x RM60000 in tax deductions. Consumers are encouraged to learn about any disciplinary issues of listed members by using the tools available from the Securities and Exchange Commission SEC. Rental income in Malaysia is taxed on a progressive tax rate from 0 to 30.

Free Online Salary and Tax Calculators designed specifically to provide Income Tax and Salary deductions for Individuals families and businesses. The rental income commencement date starts on the first day the property is rented out whereas the actual rental income itself is assessed on a receipt basis. FPA PlannerSearch offers basic information on CFP professional members of FPA.

Pdf Impact Of Tax Knowledge Tax Compliance Cost Tax Deterrent Tax Measures Towards Tax Compliance Behavior A Survey On Self Employed Taxpayers In West Malaysia Semantic Scholar

7 Tips To File Malaysian Income Tax For Beginners

The Complete Personal Income Tax Guide 2014 Infographic Tax Guide Income Tax Tax

Business Income Tax Malaysia Deadlines For 2021

15 Tax Deductions You Should Know E Filing Guidance Financetwitter

Taxation In Malaysia 2020 1 Although The Income Tax Chegg Com

Malaysian Personal Income Tax Pit 1 Asean Business News

Singapore Raises Income Tax Rates For Top 5 Per Cent And Malaysia Anilnetto Com

First Time Taxpayer Registration Guide Income Tax Malaysia 2022 Youtube

Malaysia Personal Income Tax Guide 2021 Ya 2020

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia

Malaysia Personal Income Tax Guide 2020 Ya 2019

Malaysia Personal Income Tax 2021 Major Changes Youtube

Income Tax Rate Comparison Between Malaysian Singaporean R Malaysia

Malaysia Personal Income Tax Guide 2020 Ya 2019

Malaysia Personal Tax Relief Ya 2019 Cheng Co Group

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

0 Response to "what is income tax malaysia"

Post a Comment